After a serious crash and costly insurance gaps, a USA Cycling member launched BikeInsure to offer cyclists reliable protection for bikes and injuries.

Unexpected Crash Highlights Insurance Flaws

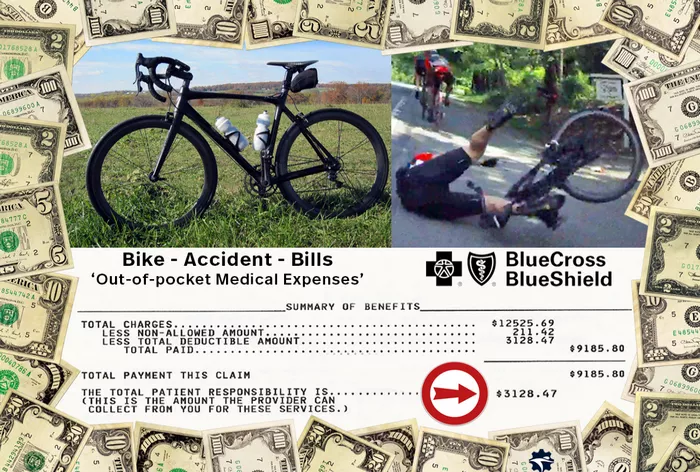

During a routine group ride, a USA Cycling RIDE+ member encountered a dangerous object on the roadside — a loose hubcap. The resulting crash severely damaged the rider’s road bike and caused significant personal injuries. Despite having both homeowner’s and health insurance, the cyclist faced substantial out-of-pocket expenses and quickly realized the limitations of traditional insurance coverage for bicycle-related incidents.

Homeowner’s Insurance Falls Short

The cyclist had previously invested in a “Scheduled Insurance Rider” under a homeowner’s policy, assuming it would cover the value of the bike. However, making a claim through homeowner’s insurance risked premium increases and potential non-renewal of the policy. Furthermore, the health insurance policy failed to fully cover the medical bills, leaving the cyclist with thousands in uncovered expenses.

BikeInsure Launches to Fill the Gap

This personal experience prompted the creation of BikeInsure, a dedicated insurance solution specifically for bicycles, e-bikes, tricycles, and adaptive cycles. BikeInsure offers standalone protection for accidental damage, theft, and transport-related losses, with only a $100 deductible. It also insulates the rider’s homeowner’s policy from claim-related risks.

Since 2023, BikeInsure has been the official bike insurance provider for USA Cycling, providing affordable and focused coverage nationwide. It is underwritten by Great American Insurance Company, which holds an A+ (Superior) rating from AM Best.

Injury Coverage Through USA Cycling RIDE+

In addition to BikeInsure, USA Cycling offers On-the-Bike Injury Insurance through its RIDE+ and RACE+ membership levels. This benefit addresses out-of-pocket medical expenses that health insurance doesn’t fully cover. With out-of-pocket maximums reaching $9,200 for individuals and $18,400 for families under 2025 Marketplace plans, this additional coverage can be critical.

The cyclist’s medical bills totaled $12,525.69, of which $9,185.80 was paid by a healthcare provider. The remaining $3,128.47, which would normally fall on the individual, was eligible for reimbursement under the RIDE+ policy, currently underwritten by Berkley Insurance, also rated A+ by AM Best.

Key Differences Between Coverage Types

Bike Insurance: This optional coverage protects the physical bike and its components from theft, damage during transit, and crash-related destruction. It operates independently of a homeowner’s insurance policy, avoiding claim-related penalties or premium hikes.

On-the-Bike Injury Insurance: Offered through USA Cycling memberships, this benefit helps cover uncovered medical costs from bicycle accidents. Riders enrolled in RIDE+ or RACE+ can receive up to $50,000 for out-of-pocket medical expenses.

Why Specialized Insurance Matters

Many cyclists wrongly believe homeowner’s insurance or health insurance is sufficient. However, both fall short when it comes to cycling-specific needs. Filing a bike claim through homeowner’s insurance can lead to financial consequences far beyond the value of the claim. Likewise, health insurance plans often leave injured riders with large bills due to deductibles and exclusions.

BikeInsure addresses these issues directly, providing reliable, standalone protection that doesn’t interfere with other policies. It ensures that a crash doesn’t become a long-term financial setback.

Nationwide Coverage, Trusted Partners

BikeInsure is now the official partner of USA Cycling, IMBA, and USA Triathlon. The company offers nationwide coverage, with licensed insurers operating in all 50 states and Washington, D.C. Backed by over 150 years of insurance experience, its underwriter, Great American Insurance Company, offers a solid foundation of trust and reliability.

Simple Enrollment for Cyclists

USA Cycling members can sign up for discounted bike and e-bike insurance at USACinsure.com. Enrolling in BikeInsure takes just minutes and allows cyclists to ride with confidence, knowing both their equipment and medical expenses are fully protected.

Conclusion: A Safer Ride Starts with Smart Coverage

As more cyclists recognize the gaps in traditional insurance policies, specialized products like BikeInsure and USA Cycling’s RIDE+ membership are becoming essential. With dedicated bike protection and injury reimbursement, riders can focus on the road ahead — not the financial risks behind them.

Related topics

- Is Road Cycling Good for Weight Loss?

- How Long Do You Need to Bike to Lose Weight?

- What Benefits Do You Get From Cycling?